what are roll back taxes

581-3237 of the Code of Virginia and the split off or subdivision of lots Title Sec. The Alliance to Roll Back Taxes was a non-partisan grassroots campaign committee formed to put the 2010 Massachusetts ballot initiative to Roll Back the State Sales Tax to 3 Question.

Bipartisan Support To Roll Back Delaware S Realty Transfer Tax Whyy

Purchasers and sellers now will need to.

. The rollback taxes can be. Anand Pathmakanthan of Maybank Investment Banking Group says its very clear that the country needs higher taxes and should roll back subsidies but the parties have. What are roll-back taxes in Virginia.

Effective January 1 2021 rollback taxes on real property converted from agricultural use to some other use will be imposed in the year of change in use and the three. The roll-back tax occurs because the tax dollars saved under the land use program are only a deferment based on the use of the land. Effective January 1 2021 rollback taxes are to be assessed over a three-year period rather than the previous five-year period.

When deferred taxes are based on land-use exemptions they can be collected at a later date if the situation changes and the land no longer qualifies for the exemption. The taxes on a parcel in the land. What are Rollback Taxes.

In 2019 legislation was passed to reduce the number of years from 5 to 3 years in which the roll-back tax could be assessed on a change in special use agriculture and timber. Changing to a non-qualifying use rezoning to a more intense use Sec. Essentially the rollback tax is the difference between the amount the land owner owed in property taxes and the amount the land owner would have owed had there been no.

This deferred tax is referred to as the rollback tax and Virginia Code requires that landowners who convert their land to an ineligible use must pay back to Roanoke County the rollback tax. Rollback taxes are calculated on the difference between what was paid under agricultural use verses what would have been paid as nonagricultural property. Deferred taxes are taxes that could have been collected but were not.

1 day agoA new report shows him receiving a tax break for his principal residence in Texas. Meanwhile hes running for Senate in Georgia. Section 12-43-210 subsection 4 requires that when the use of agricultural land changes to a non-agricultural use that a rollback in taxes be paid.

The Roll Back Taxes ballot measure Question 3 was a 2010 citizen initiative in Massachusetts USA to roll back the state sales tax. It was the boldest and most serious threat to high. Roll-back taxes shall be imposed upon the tract of land leased by the landowner for wireless or cellular telecommunications purposes and the fair market value of that tract of land shall be.

When roll-backs are issued the taxes owed are based on the difference between land use value and fair market value for the current year. If they decide not to do so the county will assess a rollback tax. Means taxes in an amount equal to the taxes that would have been payable on the property had it not been tax exempt in the current tax year the year of sale or.

When the land is sold the new owner may continue to produce the crop and claim the agricultural exemption. When a piece of property changes from agricultural to commercial or residential use th See more.

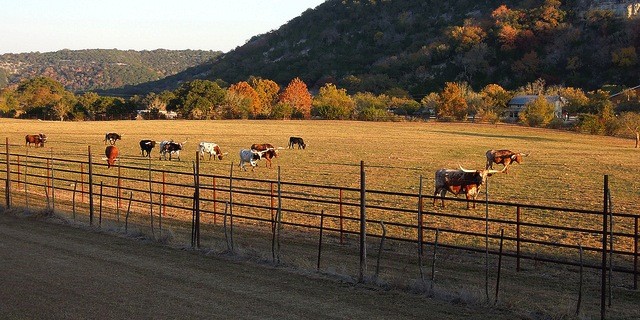

How To Calculate Texas Rollback Taxes Pocketsense

Canno T Pay House Tax After The Rollback Bug Reports New World Forums

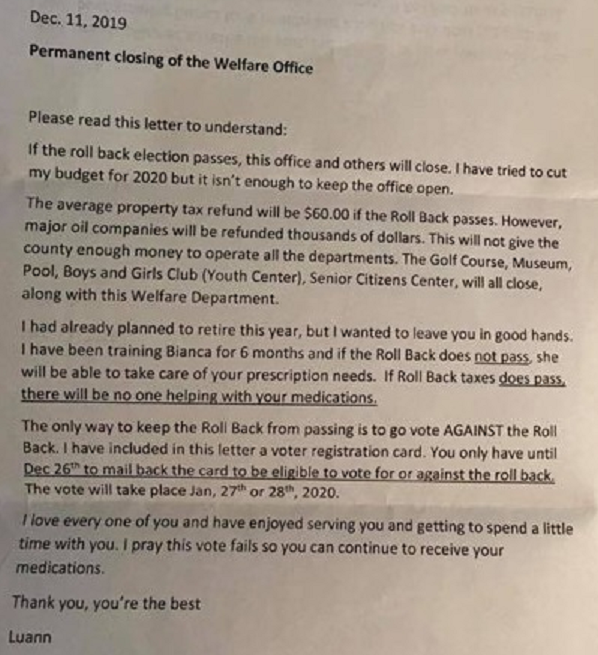

The Nastiness Of Scurry County Officials In Trying To Keep Their Massive Tax Increase Pratt On Texas

June 10 1983 2 Groups To Push For Tax Rollback Newspapers Com

Bulloch Board Of Education Announces 5 54 Tax Increase Over Rollback Millage Public Hearings Aug 8 And 15 Allongeorgia

Solved Months Of Rollback Tax The Texas Rollback Taxes Chegg Com

Buying Van Alstyne Land Don T Get Rolled With Rollback Taxes

Commissioners Looking At Full Rollback On Tax Millage Wrwh

Georgia Lawmakers Ask Mayor Miller To Lower Property Taxes Early 13wmaz Com

Rollback Taxes May Cost Us 100 000 On A Current Land Deal Here S What You Need To Know Land Sale Tx

Boe Announces 5 54 Tax Increase Over Rollback Millage Rate

California S 40 Year Old Tax Revolt Survives A Counterattack The New York Times

California Voters Reject Proposal To Roll Back Limits On Commercial And Industrial Property Taxes Nbc Los Angeles

Wyo Republican Leaders Request Special Session For Gas Tax Holiday Roll Back Property Taxes Cowboy State Daily

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/XG7G6DT4SENYSHBA3GCD62F25M.jpg)

Is Your Government Running Up The Score In The Last Days Of The Old Property Tax Law By Raising Taxes

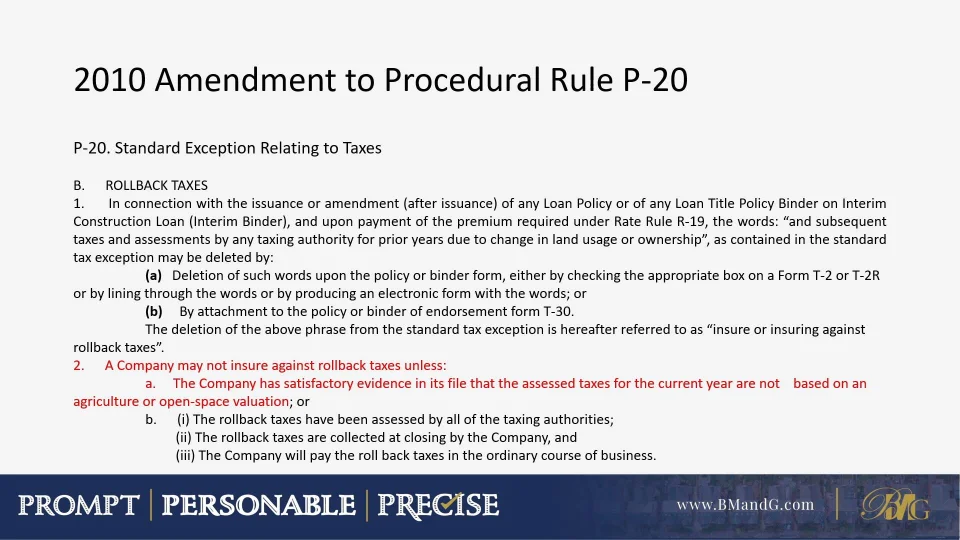

Underwriting Q A Rollback Taxes And Supplemental Taxes Texas Fnti First National Title Insurance Company

Definition Of Rollback Taxes Sapling

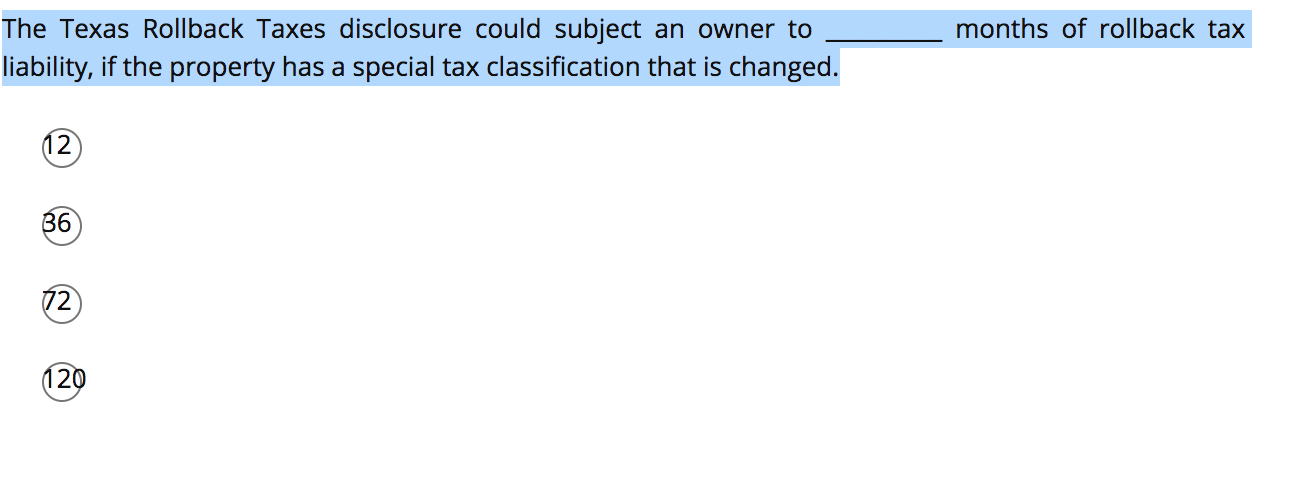

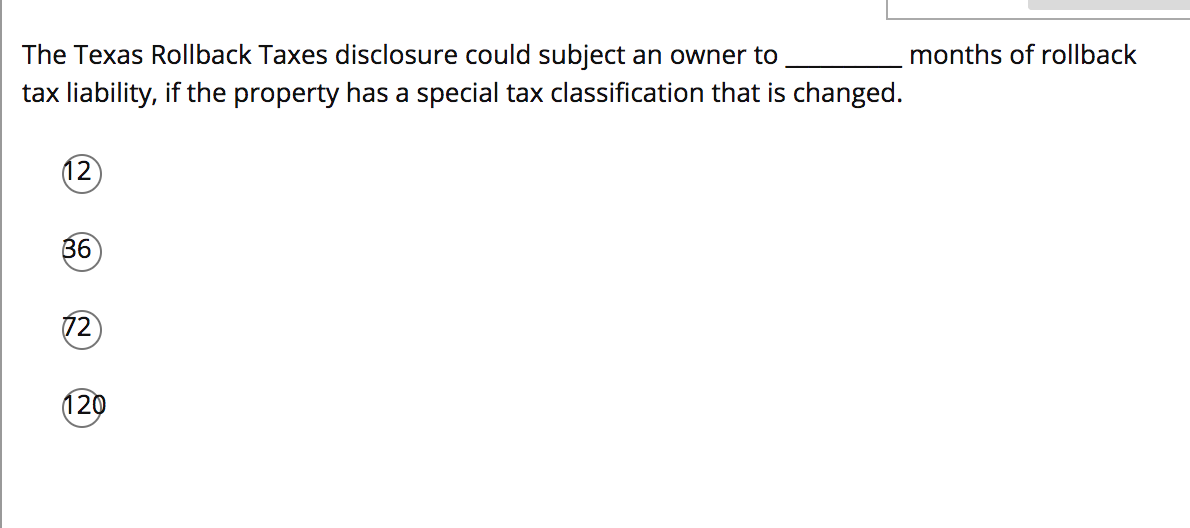

The Texas Rollback Taxes Disclosure Could Subject An Chegg Com